Polestar brings you the first of our insights into the UK mid-market software and technology sector. This report provides a snapshot of the trends we are observing in the UK M&A market where the enterprise value of the business is less than £500m. The analysis shows the following:

Overview

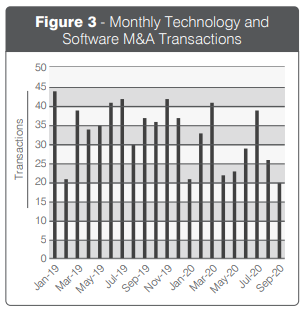

- Prior to March 2020 the M&A mid-market was active with the number of transactions increasing between Jan-17 and Dec-19, illustrated in Figure 1.

- Figure 2 supports the anecdotal evidence that Brexit uncertainty has had a impact on UK mid market M&A activity with the number of transactions involving European buyers remaining relatively flat during the period, a trend which we expect to continue in the near future. Growth has come from domestic and US buyers, maybe on the back of the current exchange rate?

- The first UK lockdown brought a sudden reduction in completions across all industries as buyers and investors analysed the immediate and future impact on trading. Buyers have typically opted to delay transactions rather than pull out altogether, with the number of completions rising between May-20 and July-20. The anticipated rise in CGT prompted sellers to evaluate exit options which may result in Q4 20 and Q1 21 activity beating expectations.

- Since the summer we have seen technology and software businesses remaining relatively resilient to Covid where the nature of their recurring revenue business models is in non-consumer sectors. Assets that have traded well in the period have attracted significant interest from trade and Private Equity buyers who remain keen to deploy funds.

Valuation

Technology and software businesses are increasingly adopting SaaS business models resulting in revenue that is ongoing or recurring in nature.

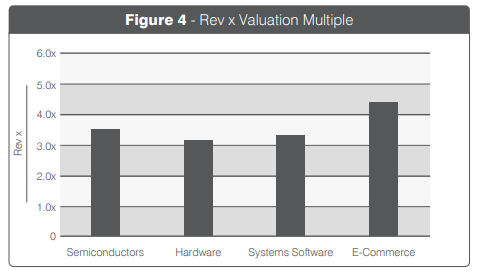

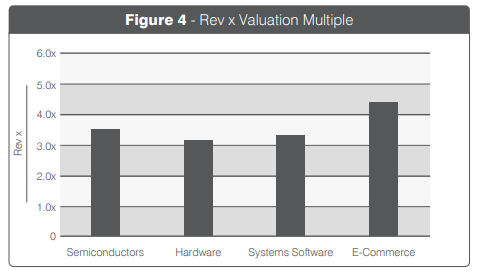

- Revenue valuation multiples can vary significantly and our analysis indicates that technology and software businesses command an average revenue multiple between 3-4x.

- The data shows that buyers in 2020 paid higher multiples for technology and software assets than in previous years, as we would expect given the market shift to the digital economy.

- The recurring revenue nature of these businesses means that investors and buyers are more comfortable in paying a premium for businesses that can demonstrate good visibility of future revenue/earnings. The change in working models with many companies moving to home working environments in a short period has resulted in businesses increasingly replying on technology.

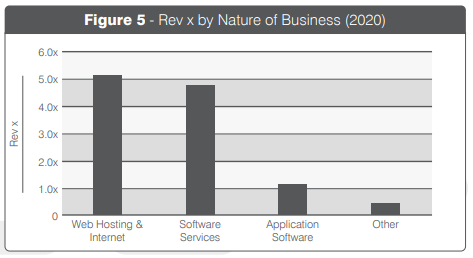

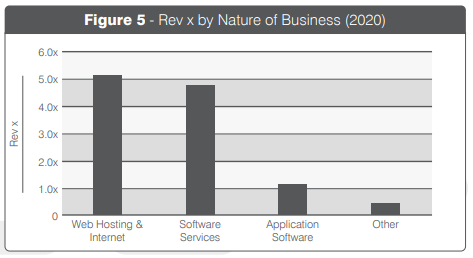

- Multiples vary significantly between sub-sectors with the nature of business commanding different valuation multiples.

- Multiples for technology and software businesses are driven by quality of revenues and earning, comprising recurring revenue quantum, growth rates and margins, churn rates, profitability and cash conversion (post CAPEX)

- For more information and detailed analysis, the Polestar white paper on SaaS valuations provides useful insight into multiples in this sector. Click here for the White paper

The full report can be downloaded using the link in this post. The source of data for our analysis is Zephyr, a database of M&A transactions both in the UK and globally. If you have any questions about our findings or would like to discuss how these trends may affect your business, please do get in touch.