The dollar is often seen as one of the wrecking balls of the financial system and influences many corners of the market.

88% of world trade is written in dollars (Source: WSJ); even beyond the US, many firms must borrow in dollars to lease equipment/machinery and it accounts for roughly 60-70% of foreign currency reserves.

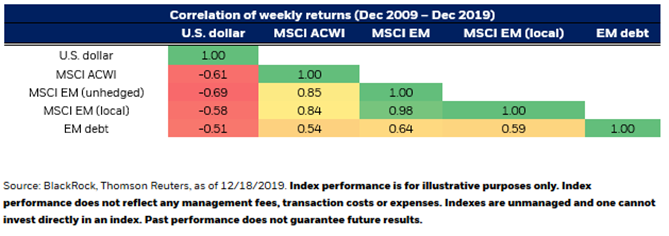

(Source: Black Rock)

We can see the these factors reflected in the pronounced negative correlation between the dollar and emerging markets. (Since a large proportion of debt and equipment leasing from abroad is written in dollars – when the dollar rises these costs increase feeding into under performance from emerging markets).

The potential demise of the dollar has been widely covered across the financial media.

Bear Case (Downside Case)

The first fundamental driver is the increasing budget deficit and the return of quantitative easing.

One of the things that has become abundantly clear over the past five years is that the federal reserve has no exit strategy. Coming out of 2008, markets reacted positively to low rates and quantitative easing because it was seen to be temporary. Everyone thought that the central banks would normalize interest rates, shrink the balance sheet and Bob’s your uncle – back to normal – and it was this narrative which kept the music playing. Since then we have seen lower interest rates for longer, record levels of debt issuance and contrived financial acrobatics (such as share buy backs) re-distributing wealth to shareholders.

Now since COVID the federal reserve have showed their resolve in backstopping any kind of liquidity crisis with a variety of bond, asset backed security and dollar liquidity lines for the financial economy together with stimulus checks for the real economy. All this has resulted in an astronomically large budget deficit and with it – a quickly rising Debt to GDP. It’s for this reason there is so much talk about Modern Monetary Theory (which isn’t modern at all) and in practice is a lot like monetizing debt,

N. Gregory Mankiw critiques MMT in his “A Skeptic’s Guide to Modern Modern Theory observing that “a government with its own currency faces no financial constraints, but all countries face real resource constraints. If a budget deficit adds more demand than the real economy can handle, inflation will result.” Rising inflation goes hand in hand with a falling currency (in real terms) and is a narrative not to be ignored.

To add to the dollar’s woes the US is sustaining a failing US shale industry with the worst break-evens in the world, sitting at around $30 according to Bloomberg intelligence. Compared to their Saudi and Russian counterparts the future of the US shale industry is looking bleak. Generally significantly lower exports result in lower demand for a certain currency and subsequently a decline in it’s value.

On top of this we now have interest rates fixed at zero as indicated by the dot plot until at least 2022. In theory this will chip away at the incentive to be invested in treasuries denominated in dollars which could tempt yield-hungry money out of the US and further down the risk curve into EM sovereigns.

(Source: Federal Reserve)

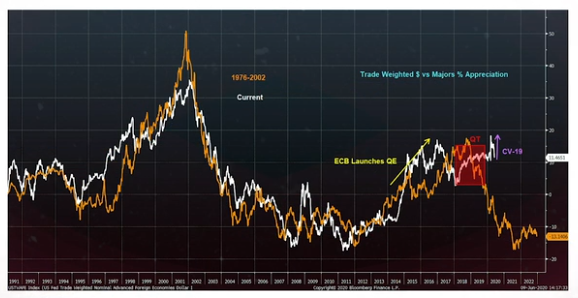

There are also a slew of technical factors that certain macro strategists have been eyeing for the demise of the dollar, the first being potential mean reversion of the DXY (Dollar trade weighted index) vs the majors in percentage appreciation:

(Source: Global Macro Investor)

Another reason is more to do with timing and looks at dollar cycles since the Bretton Woods agreement. The chart below shows how the dollar has sold off three other times immediately following an event driven risk-off rally (in this case – COVID 19):

(Source: Global Macro Investor, Real Vision)

As always, markets are volatile and when it comes to directional currency bets, it really is anyones guess.

a government with its own currency faces no financial constraints, but all countries face real resource constraints. If a budget deficit adds more demand than the real economy can handle, inflation will result.