Here at Polestar, we have covered the healthcare sector throughout the years with deals, clients, and research. Healthcare is a prominent sector within our history, with previous deals such as Kims Hospitals, The London Clinic, and Sepctra Care Group just to name a few.

Since joining Polestar, I have done my share of research within the field through a recent valuation on Healthcare and Education Q1 21′ and previous blog posts that cover healthcare technology.

While doing my valuation for quarter one, I found the managed care subsector to be of interest while reading various articles talking about how this sector is expected to boom. In this blog post, I will dig deeper into the managed care sector and the outlook beyond 2021.

Background about the ageing population

The UK adult social care sector is estimated to be valued at £42bn. Through an ageing population, adult social care is going to increase within the next two decades.

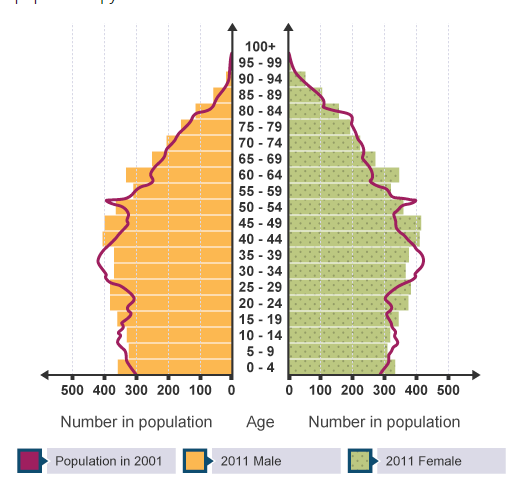

The UK’s population pyramid shows that the country’s population structure demonstrates an ageing population. This well documented population structure is caused by two reasons: declining birth rates as well as increasing life expectancy. The declining birth rate was a result of women at work, tertiary education, and a focus on family planning education. The increasing life expectancy was a result of universal healthcare, advancements in medical technology, and a decrease in manual employment. Because people are living longer and having less kids, this will have a positive effect on the demand of adult social care.

Paid care and healthcare

There will be various effects of an ageing population in the healthcare sector. Demand will increase as the population ages, specifically in geriatric wards and for expensive specialist health services such as hip replacements. Because of a rise in demand, there might be higher costs and also the possibility of a shortage of staff.

An ageing population will also require paid care and home care. This will cause a spike in demand in paid care staff and retirement homes. The demand for long-term care amongst older people in the UK requires 110,000 additional beds over the next decade. The ’85’s and over’ age group is expected to increase by 27.5% per annum to 2030, with an estimated 460,000 more people in this age group in the next decade. This is seven times the growth rate of the overall UK population and 16 times faster than the working age population.

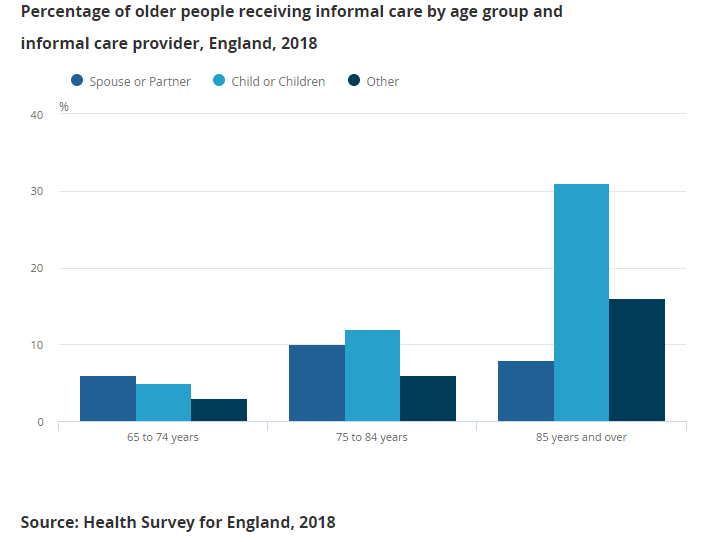

The Office of National Statistics (ONS) reported that adult children are the most common providers of informal care for those at the oldest ages. However, there is a decrease in the number of children being born. The ONS estimates that by 2040, there will be a large number of people aged in their 70’s who do not have children. These people will be in their 80’s in 2050, where they will require care.

However, for the older population who do have children, there may not be a possibility for the children’s willingness to provide care. The potential for their adult children to provide care is dependent on the availability of the children to provide care, their proximity to their parents, and the children’s relationship with their parents.

COVID-19 impact

The coronavirus impacted the care home sector tremendously. Although care homes are equipped to deal with seasonal outbreaks like the flu and diseases such as dementia, the pandemic was unprecedented. It put a lot of pressure onto staff and the sector had to adapt quickly to new guidelines.

The coronavirus impacted older populations more than younger ones. ONS data, compiled from the General Register Office, shows that from 1st March to 7th June there were approximately 29,178 excess deaths (over and above 2019 levels) across care homes in England and Wales.

The rise in mortality led to led to a 8.5% decrease in occupancy rates in UK care homes throughout Q2 and Q3 in 2020.

On a positive note, the decline in occupancy rates normalised by early June and the sector saw new admission rates.

The biggest additional cost from the pandemic was PPE equipment. Managed Care operators spent an average of £160 per bed per annum on PPE during the 2019/20 financial year, compared to £260 per bed during the second quarter of 2020 alone.

In addition to the PPE, the rise in staffing has been another cost. Irregular spending on staffing will have added to existing high staff costs. Many care homes had to support existing staff during periods of isolation, while at the same time recruiting new staff to fill gaps in the workforce. UK care homes spent 61.3% of their income on staffing in the second quarter of 2020.

Outlook 2021 onward and final thoughts

Although the pandemic had a negative short-term effect on the UK care homes sector, early signs of data show admission rates stabilizing back to normal. The vaccination programme in the UK has also been successful, inoculating most of the vulnerable people in the country.

As we move on from the pandemic, the adult care home sector will go back to pre-pandemic levels and have a positive increase within the next two decades as the population ages. Here at Polestar, we look forward to working with clients in this growing field, and conducting more research. Please reach out to us if you are interested in our services or in our research!

In the future, there will be more older people and a higher proportion of those will be childless. Because adult children are the most common providers of informal social care to their parents at older ages, this is likely to increase the demand for paid-for care.