This report spotlights the UK food and leisure sector for Q1 21, aggregate sector valuations and private market activity. We have summarised our report below but, if you are interested in viewing the full document, click here to read more.

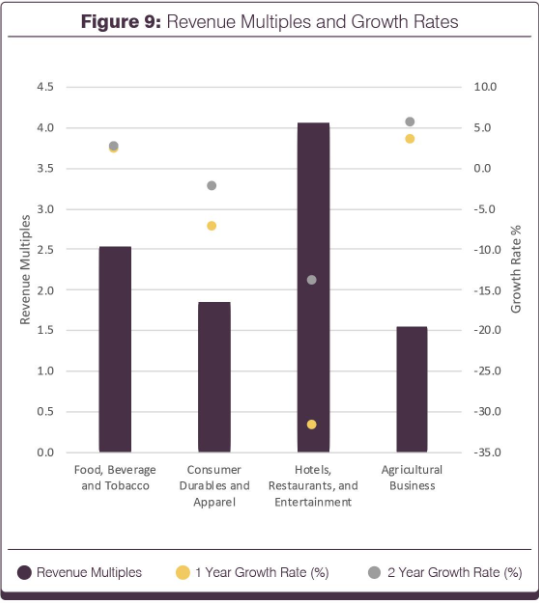

Listed comparables can provide a good indication of value. We have summarised UK listed companies in both food and leisure, further split down into ‘food, beverages and tobacco’, ‘consumer durables and apparel’, ‘hotels, restaurants, and entertainment’, and ‘agricultural business’ subsectors.

This past year, the pandemic has affected all sectors all over the globe. However, the picture is somewhat mixed as not all the data is fully reflected in the historic published numbers.

The food, beverages, and tobacco subsector last quarter faced supply chain issues due to COVID-19 and Brexit. However, consumer spending has been mixed. Net spending on groceries fell 9% Q1 21, and alcohol and tobacco fell by 14% compared to Q4 20, although this may not be a true representation due to spending spikes around Christmas.

In the consumer durables and apparel subsector, demand also shifted downwards. With the shutdown of non-essential businesses across the country, reduced hours and average incomes, consumer priorities have seen some shift toward basic and essential needs and reduced demand for items such as automobiles and apparel. However, this quarter we have seen some improvement in consumer confidence and we expect this subsector to grow once non-essential businesses and the rest of the economy open up.

The hotels, restaurants, and entertainment subsector has been the most affected due to the bulk of the operators being considered not just “non-essential”, but in fact detrimental to the general social distancing approach. Strategies to decrease COVID-19 transmission rates such as community lockdowns, social distancing, stay-at-home orders, travel and restrictions have resulted in the temporary closure of many hospitality businesses and significantly decreased demand for those that were allowed to continue to operate, such as restaurants offering take-away services. Significant changes are being forced on this sector, with COVID-19 laws to ensure health and safety for customers. Further recovery in this sector will be dependent on when travel restrictions can be lifted bringing hotels and entertainment back to life.

The agricultural business subsector was less affected by COVID-19 in the sense that food is an essential product, with routes to market, largely through the supermarket sector, already in place. That said, many businesses with demand primarily from the leisure industry were forced to pivot quickly to find other channels or suffer significant revenue shortfalls.

The food, beverages, and tobacco subsector saw a positive growth rate of 2.2% this past year. This subsector faced some supply issues due to Brexit and COVID-19, but growth is expected to pick up once lockdown restrictions are lifted and the economy recovers. For the consumer durables and apparel subsector, the rise of online shopping and markets has caused the industry to change structurally. The hotel, restaurant, and entertainment subsector crashed by almost a third, with a negative growth rate of -31.9% over the past year as it struggled to accommodate travel restrictions and social distancing laws. The agriculture business sector saw positive growth of 3.4% this past year. Similar to the food, beverages, and tobacco subsector, there were some supply issues related to both Brexit and COVID-19. However with supermarkets remaining open a large part of the route to market remained secure.

Overall the food, beverage, and tobacco subsector maintained its margins at 13%, despite the pressures on the supple side ad extra costs associated with health and safety, supported by consistent demand. Individual company profitability depended on the products and supply channels. The consumer durables and apparel subsector faced reduction in consumption throughout the pandemic due to stores being closed during lockdown. The hotel, restaurant and entertainment subsector had the lowest EBITDA margin compared to the other subsectors due to COVID-19, which impacted the sector with some closures/restrictions and additional costs. The agricultural business subsector had the highest EBITDA margin compared to the other sectors in the food and leisure sector. We only had a small number in our data set, so the number for EBITDA margin should be used with caution. With input costs rising, agricultural commodity prices declining, and trade issues, we do expect this subsector to have some profitability issues but demand will increase once lockdown measures are eased.

For operators in the food and leisure sectors, the following leading players illustrate the high growth and valuation metrics that can be achieved across this space.

The following charts show the number of deals in the food and leisure sector.

If you are interested in digging into the data, or seeing some of the key selected private transactions , *the full report can be downloaded here.*

Our data is sourced from a mixture of Capital IQ / Zephyr which are both reputable databases for M&A transactions across the globe. If you have any questions about our findings or would like to discuss how these trends may affect your business, feel free to reach out to us!