Compared to other industries we follow, the construction sector has always been slower to adopt new technology. According to Mckinsey, it’s been a decade since construction players began embracing digital solutions. However, since Covid, it is the time to reshape the industry.

Top construction companies were already investing heavily in technology pre-pandemic, but Covid left a very bad taste in their mouths. With having to deal with shrinking backlogs, competitive bidding environments, and supply shortages, it became clear that the solution is going to be very similar to other industries: go digital or go home.

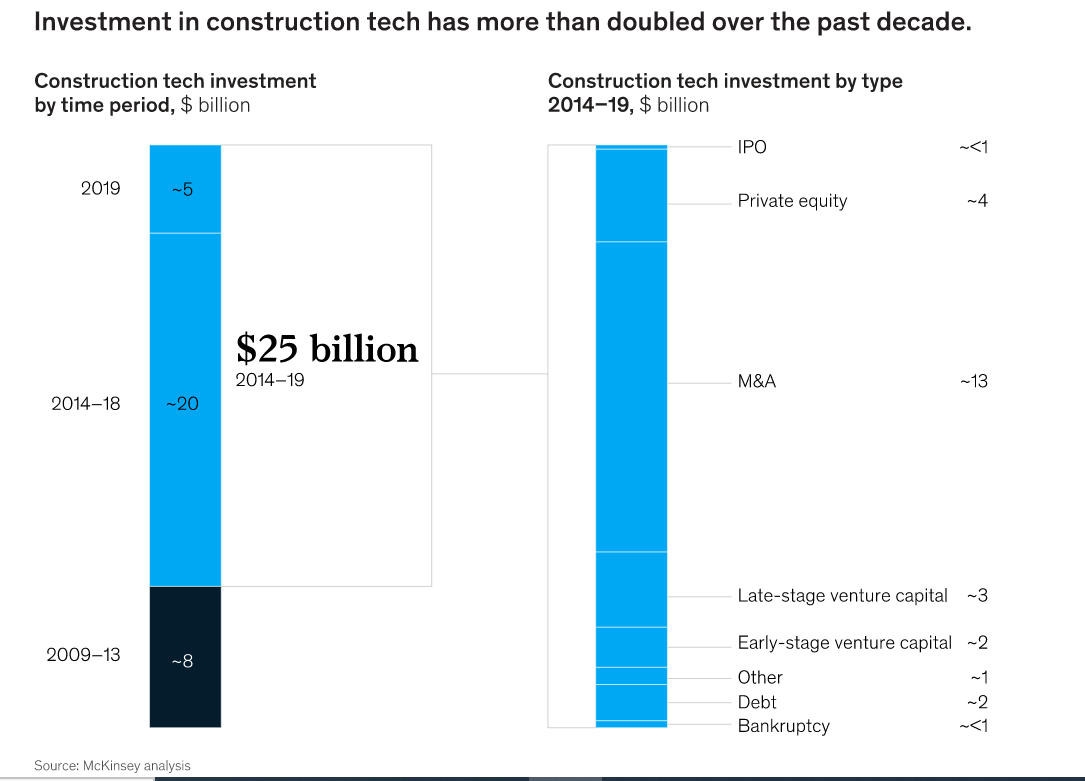

According to Mckinsey’s data, most construction companies are now using 3-D printing, modularization, robotics, digital-twin technology, artificial intelligence, and supply-chain optimization and marketplaces. A lot of this has been made possible with the funding from the private sector. Mckinsey stated that “the industry has continued to grow briskly with venture-capital (VC) activity rising to several billion dollars at the end of 2019 from low levels a decade ago. VC investment in construction tech outpaced the overall VC industry 15-fold through 2019, with clear indicators for continued momentum”.

In addition to private funding, the construction industry has also seen significant consolidation due to M&As. Construction technology, because of its novelty, is a very fragmented market. From Mckinsey’s data, there was about $25 billion worth of investments into engineering and construction technology in the last five years. Of that $25 billion, $17 billion in transactions involved either M&A activity or private equity (PE) investment.

Out of this market activity came a shift towards integrated platforms. 20% of construction companies now offer solution suites, compared with just 13% in 2017. Platforms are attractive because of their ability to increase customer stickiness and recurring revenues.

This is the perfect time for investors to take advantage of the market. Because of the fragmentation, there could be a buy-and-model strategy towards construction companies that can offer more automated and integrated solutions.

This growth in investments shows that larger construction companies will need to continue to scale to remain competitive. SMEs will need to digitise to keep up their revenues and competitiveness.

Whether you are a PE firm interested in a buy-and-build approach, or an SME that wants to digitise, Polestar can help you with all your enquiries. Feel free to reach out!

Financial and strategic investors continue to fuel a rapid expansion of the construction technology industry. The pandemic has only served to provide additional urgency.