This report spotlights the UK software and technology sector for H1 21, aggregate sector valuations and private market activity. We have summarised our report below but, if you are interested in viewing the full document, click here to read more.

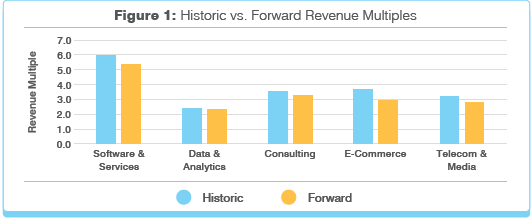

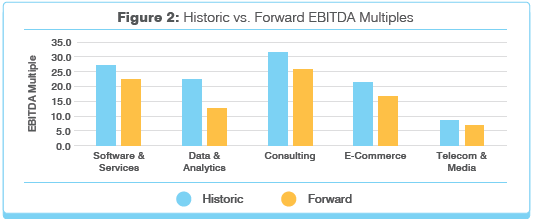

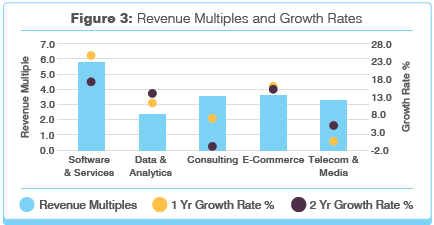

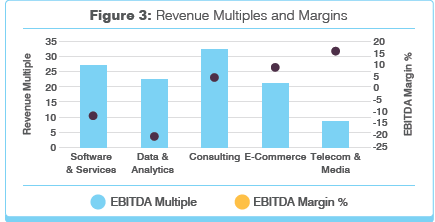

Listed comparables can provide indication of value. We have summarised UK listed companies in both software and technology, further split down into ‘software and services’, data and analytics’, ‘consulting’, ‘E-commerce’, and ‘telecom and media’ subsectors. The consulting subsector includes companies that also have software and data services. The valuation for those will come from the software and data side instead of consulting, resulting in higher multiples.

The technology sector expanded during H1 2021, despite a drop in activity at the start of the third lockdown in January. In February and March, this output picked up allowing recovery through the end of the first quarter.

Demand in employment is highest since Q2 2019 and this quarter has seen the strongest output growth projections for nearly seven years.

Remote working caused growth to accelerate within this sector, but the question remains whether this growth rate will drop or be maintained after lockdown restrictions ease.

Multiples and Margins

Positive growth rates within this sector indicate how lifestyle changes affected demand throughout the UK. Employees shifted to a ‘work from home’ lifestyle and consumers shopped through online platforms.

These changes increased demand for virtual meeting platforms, e-commerce stores, and the need to understand data within these areas throughout lockdown. This sector was able to remain open and functioning throughout the pandemic compared to the areas of the UK which allowed it to maintain its profitability.

Though many will see the benefits of returning to a shared business environment as lockdown ends, we anticipate that much of the recent shift towards increased technology usage for communications will be maintained as learned efficiencies become standard practice. Thus, although growth rates may level off temporarily as lockdown ends, this sector will remain profitable, and is likely to enjoy growth rates reverting to trend over a relatively short time frame.

For subsectors such as e-commerce, growth/growth rates remain in question as lockdown measures ease with UK residents becoming less reliant on technology as consumers take the opportunity to embrace the freedom and social aspects of offline.

The EBITDA margins for the software and services and data and analytics subsectors may not be an accurate representation across the entire sector. The companies within our data set were newer technology companies, which had negative EBITDA margins associated with them that skewed our data set negative.

Aspirational Growth

For operators in the software and technology sector, the following businesses illustrate the high growth and valuation metrics that can be achieved across this space.

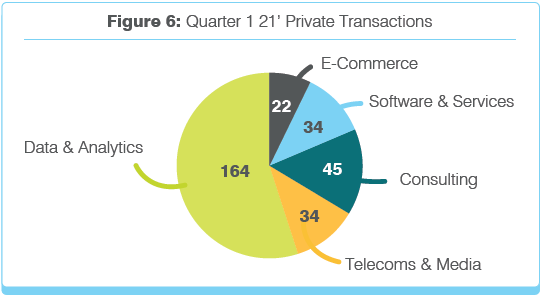

Software and Technology in the Private Markets

Technology companies are more optimistic about the near-term growth than any time since the Q2 2014. COVID-19 resulted in a sharp dive in business acvitity in 2020, even lower than the financial crash in 2009. However, business confidence is now back on the market, which is one of the reasons for higher valuations.

Private Company Metrics

With other sectors, such as Food and Leisure, hit hard by social distancing and lockdown rules, and the software and technology sector thriving through remote working and schooling, investors with funds to deploy have concentrated on this sector.

We expect the software and technology sector to continue to enjoy high levels of M&A activity as technologies converge, data and digitisation continues apace and market sub-sectors continue the drive towards consolidation, particularly in the mid-market where several PE backed platforms are actively pursuing “buy & build” strategies.

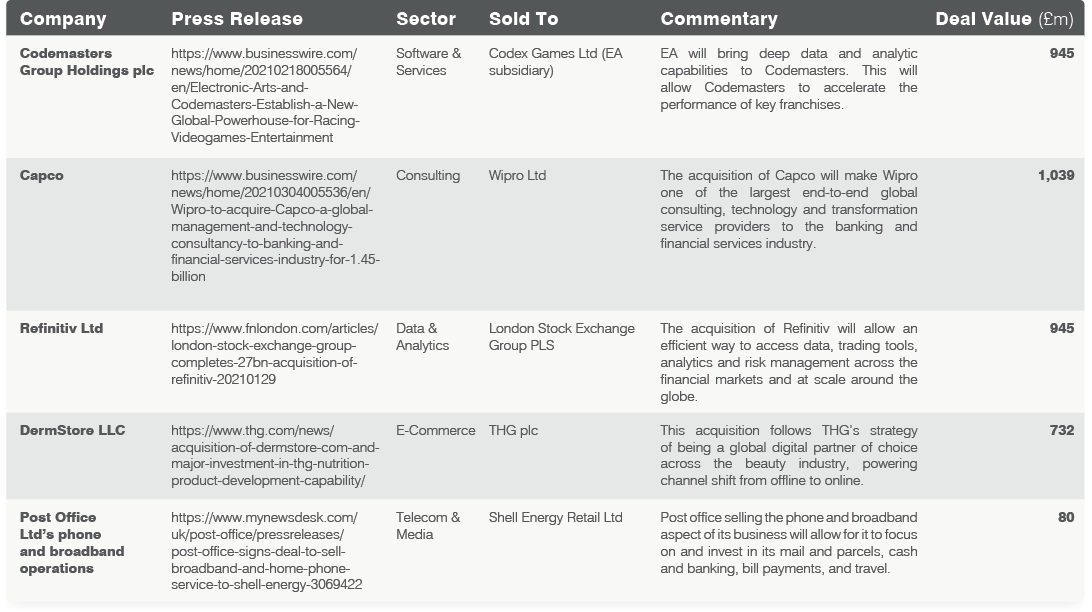

Biggest Sector Deals

If you are interested in digging into the data, or seeing some of the key selected private transactions , the full report can be downloaded here.

Our data is sourced from a mixture of Capital IQ / Zephyr which are both reputable databases for M&A transactions across the globe. If you have any questions about our findings or would like to discuss how these trends may affect your business, feel free to reach out to us!

Technology companies are more optimistic about the

near-term growth than any time since the Q2 2014.